The Observation

January is here. You walk into a premium gym. The sales guy pitches you:

- Monthly Plan: ₹3,500/month (Total ₹42k/year).

- Annual Plan: ₹12,000/year (Effective ₹1,000/month).

It’s a no-brainer. You buy the annual plan. You feel smart. But the gym owner is smarter.

By March, you stop going. You have effectively paid ₹12,000 for 2 months of usage (₹6,000/month). The gym wins.

The “Breakage” Revenue Model

In the payments and gift card industry, “Breakage” refers to the revenue gained from services that are paid for but never used.

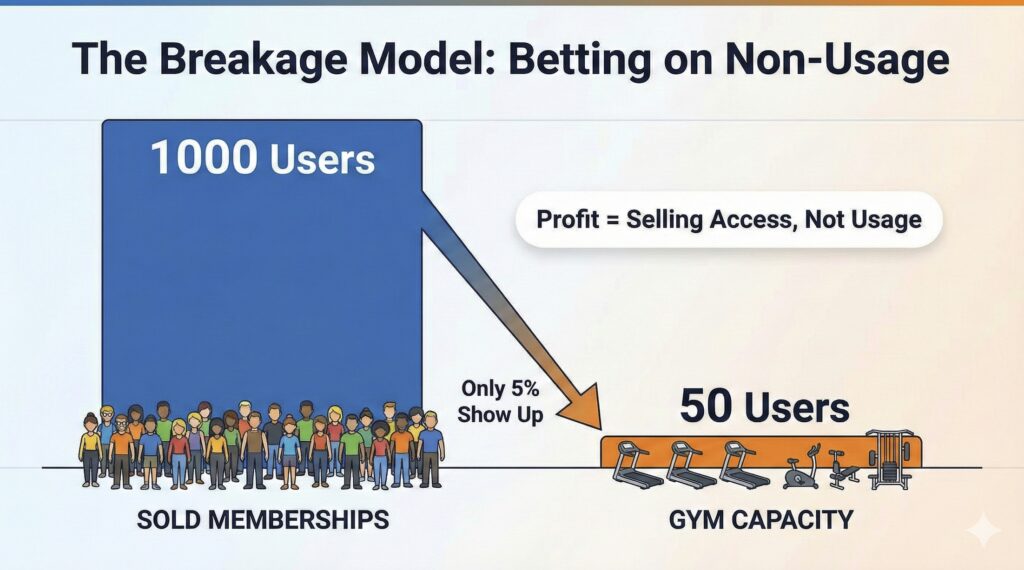

Gyms operate on Probabilistic Capacity Planning.

- Physical Capacity: The gym can fit 100 people at once.

- Sold Capacity: They sell 1,000 memberships.

They are betting on the statistical fact that only 10% of members will show up at any given time. If everyone decided to get fit on the same day, the gym’s “Server” would crash. The treadmills would run out; the AC would fail.

They are Oversubscribing their infrastructure because they know user retention is low.

The SaaS Equivalent: Seats vs. Consumption

As a Product Manager, you face this “Gym Paradox” when choosing a pricing model.

1. The “Gym Model” (Seat-Based Pricing)

- Example: Microsoft Office, Salesforce, Slack (mostly).

- Strategy: You charge per user, regardless of how much they use the tool.

- The Incentive: You want to sell as many licenses as possible to the CIO. If 50% of employees never log in, you still get paid. (Though in modern SaaS, this leads to churn, so it’s risky).

2. The “Cloud Model” (Consumption-Based Pricing)

- Example: AWS, Snowflake, Twilio.

- Strategy: You charge for every second of compute or every GB of storage.

- The Incentive: You need users to use the product heavily. If they don’t log in (like the gym), your revenue hits zero.

The PM Lesson: Capacity vs. Experience

The danger of the Gym Model is that it creates a misalignment between value and price.

- The Gym loves the customer who pays but stays home.

- The Gym hates the power user who comes twice a day and wears out the equipment.

In Product Management, we often accidentally build “Gyms.” We optimize for Sign-ups (Acquisition) rather than Active Usage (Retention).

If your dashboard celebrates “1 Million Registered Users” but your Daily Active Users (DAU) is 5,000, you are running a gym. You are making money on “Shelfware.”

That might work for this quarter’s revenue, but in the long run, low usage always leads to high churn. Unlike a gym contract, SaaS customers can cancel easily.

Conclusion

The next time you see a “Too Good To Be True” annual discount, ask yourself: Are they rewarding my loyalty, or are they betting on my laziness?

The Takeaway: Great products align revenue with value. If your customer usage goes up, your revenue should go up. If you profit from your customer not using your product, you are on borrowed time.